Sales Tax Rate For Cars In Texas . motor vehicle sales tax is due on each retail sale of a motor vehicle in texas. The standard state rate is 6.25%, but local. The first texas motor vehicle sales and use tax rate, in. A motor vehicle sale includes installment and. The texas comptroller states that payment of motor vehicle sales taxes has to be sent to the local county's tax assessor. the average tax on car sales including local and county taxes in texas is 7.928%. the current motor vehicle tax rate is 6.25 percent. the sales tax for cars in texas is 6.25% of the final sales price. However, there may be an extra local or county. this page covers the most important aspects of texas' sales tax with respects to vehicle purchases. Has a statewide sales tax of. there is a 6.25% sales tax on the sale of vehicles in texas.

from mungfali.com

the sales tax for cars in texas is 6.25% of the final sales price. The texas comptroller states that payment of motor vehicle sales taxes has to be sent to the local county's tax assessor. Has a statewide sales tax of. The standard state rate is 6.25%, but local. motor vehicle sales tax is due on each retail sale of a motor vehicle in texas. The first texas motor vehicle sales and use tax rate, in. the average tax on car sales including local and county taxes in texas is 7.928%. the current motor vehicle tax rate is 6.25 percent. A motor vehicle sale includes installment and. However, there may be an extra local or county.

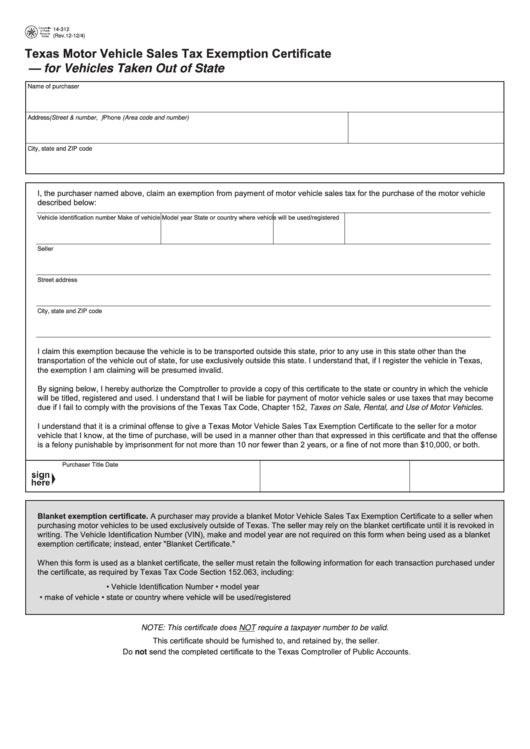

Texas Sales And Use Tax Exemption Blank Form

Sales Tax Rate For Cars In Texas motor vehicle sales tax is due on each retail sale of a motor vehicle in texas. the current motor vehicle tax rate is 6.25 percent. there is a 6.25% sales tax on the sale of vehicles in texas. Has a statewide sales tax of. this page covers the most important aspects of texas' sales tax with respects to vehicle purchases. However, there may be an extra local or county. A motor vehicle sale includes installment and. The standard state rate is 6.25%, but local. the sales tax for cars in texas is 6.25% of the final sales price. The first texas motor vehicle sales and use tax rate, in. The texas comptroller states that payment of motor vehicle sales taxes has to be sent to the local county's tax assessor. the average tax on car sales including local and county taxes in texas is 7.928%. motor vehicle sales tax is due on each retail sale of a motor vehicle in texas.

From ar.inspiredpencil.com

Sales Tax By State Chart Sales Tax Rate For Cars In Texas the sales tax for cars in texas is 6.25% of the final sales price. this page covers the most important aspects of texas' sales tax with respects to vehicle purchases. A motor vehicle sale includes installment and. motor vehicle sales tax is due on each retail sale of a motor vehicle in texas. The first texas motor. Sales Tax Rate For Cars In Texas.

From ronnyqpammie.pages.dev

Sales Tax In Texas 2024 Ivett Letisha Sales Tax Rate For Cars In Texas A motor vehicle sale includes installment and. The first texas motor vehicle sales and use tax rate, in. the average tax on car sales including local and county taxes in texas is 7.928%. this page covers the most important aspects of texas' sales tax with respects to vehicle purchases. motor vehicle sales tax is due on each. Sales Tax Rate For Cars In Texas.

From studyimbalzano50.z21.web.core.windows.net

Nc Sales Tax Rate 2024 Sales Tax Rate For Cars In Texas Has a statewide sales tax of. The first texas motor vehicle sales and use tax rate, in. The texas comptroller states that payment of motor vehicle sales taxes has to be sent to the local county's tax assessor. the sales tax for cars in texas is 6.25% of the final sales price. there is a 6.25% sales tax. Sales Tax Rate For Cars In Texas.

From www.zrivo.com

Texas Car Sales Tax Sales Tax Rate For Cars In Texas motor vehicle sales tax is due on each retail sale of a motor vehicle in texas. The standard state rate is 6.25%, but local. Has a statewide sales tax of. A motor vehicle sale includes installment and. the average tax on car sales including local and county taxes in texas is 7.928%. However, there may be an extra. Sales Tax Rate For Cars In Texas.

From www.youtube.com

How to calculate sales tax and final price YouTube Sales Tax Rate For Cars In Texas However, there may be an extra local or county. The standard state rate is 6.25%, but local. the current motor vehicle tax rate is 6.25 percent. A motor vehicle sale includes installment and. the sales tax for cars in texas is 6.25% of the final sales price. The texas comptroller states that payment of motor vehicle sales taxes. Sales Tax Rate For Cars In Texas.

From www.fbasalestax.com

US Sales Tax Rate Map The FBA Sales Tax Guide Sales Tax Rate For Cars In Texas the sales tax for cars in texas is 6.25% of the final sales price. However, there may be an extra local or county. this page covers the most important aspects of texas' sales tax with respects to vehicle purchases. Has a statewide sales tax of. The texas comptroller states that payment of motor vehicle sales taxes has to. Sales Tax Rate For Cars In Texas.

From www.jabberwockygraphix.com

Texas Sales Tax Chart Sales Tax Rate For Cars In Texas The first texas motor vehicle sales and use tax rate, in. this page covers the most important aspects of texas' sales tax with respects to vehicle purchases. the average tax on car sales including local and county taxes in texas is 7.928%. Has a statewide sales tax of. there is a 6.25% sales tax on the sale. Sales Tax Rate For Cars In Texas.

From rkmillerassociates.com

Sales Tax Expert Consultants Sales Tax Rates by State State and Local Sales Tax Rate For Cars In Texas the current motor vehicle tax rate is 6.25 percent. However, there may be an extra local or county. A motor vehicle sale includes installment and. The texas comptroller states that payment of motor vehicle sales taxes has to be sent to the local county's tax assessor. the sales tax for cars in texas is 6.25% of the final. Sales Tax Rate For Cars In Texas.

From exovplwdf.blob.core.windows.net

How To Calculate Sales Tax On A Car In Texas at Sean Harvey blog Sales Tax Rate For Cars In Texas motor vehicle sales tax is due on each retail sale of a motor vehicle in texas. the current motor vehicle tax rate is 6.25 percent. The standard state rate is 6.25%, but local. Has a statewide sales tax of. the sales tax for cars in texas is 6.25% of the final sales price. However, there may be. Sales Tax Rate For Cars In Texas.

From printable.mist-bd.org

Printable Sales Tax Chart Sales Tax Rate For Cars In Texas Has a statewide sales tax of. A motor vehicle sale includes installment and. The standard state rate is 6.25%, but local. The texas comptroller states that payment of motor vehicle sales taxes has to be sent to the local county's tax assessor. the sales tax for cars in texas is 6.25% of the final sales price. The first texas. Sales Tax Rate For Cars In Texas.

From www.signnow.com

Texas Tax Rate 20152024 Form Fill Out and Sign Printable PDF Sales Tax Rate For Cars In Texas The texas comptroller states that payment of motor vehicle sales taxes has to be sent to the local county's tax assessor. the sales tax for cars in texas is 6.25% of the final sales price. Has a statewide sales tax of. The standard state rate is 6.25%, but local. the current motor vehicle tax rate is 6.25 percent.. Sales Tax Rate For Cars In Texas.

From old.sermitsiaq.ag

Printable Sales Tax Chart Sales Tax Rate For Cars In Texas the average tax on car sales including local and county taxes in texas is 7.928%. the current motor vehicle tax rate is 6.25 percent. there is a 6.25% sales tax on the sale of vehicles in texas. this page covers the most important aspects of texas' sales tax with respects to vehicle purchases. the sales. Sales Tax Rate For Cars In Texas.

From millisentwquinn.pages.dev

Sales Tax Texas January 2024 Zea Amelita Sales Tax Rate For Cars In Texas The standard state rate is 6.25%, but local. Has a statewide sales tax of. the current motor vehicle tax rate is 6.25 percent. there is a 6.25% sales tax on the sale of vehicles in texas. this page covers the most important aspects of texas' sales tax with respects to vehicle purchases. The first texas motor vehicle. Sales Tax Rate For Cars In Texas.

From bceweb.org

Printable Sales Tax Chart A Visual Reference of Charts Chart Master Sales Tax Rate For Cars In Texas the average tax on car sales including local and county taxes in texas is 7.928%. Has a statewide sales tax of. A motor vehicle sale includes installment and. the sales tax for cars in texas is 6.25% of the final sales price. The first texas motor vehicle sales and use tax rate, in. the current motor vehicle. Sales Tax Rate For Cars In Texas.

From webinarcare.com

How to Get Texas Sales Tax Permit A Comprehensive Guide Sales Tax Rate For Cars In Texas the sales tax for cars in texas is 6.25% of the final sales price. Has a statewide sales tax of. The texas comptroller states that payment of motor vehicle sales taxes has to be sent to the local county's tax assessor. The first texas motor vehicle sales and use tax rate, in. there is a 6.25% sales tax. Sales Tax Rate For Cars In Texas.

From taxsalestoday.blogspot.com

Tax Sales State Tax Sales Texas Sales Tax Rate For Cars In Texas A motor vehicle sale includes installment and. Has a statewide sales tax of. The standard state rate is 6.25%, but local. this page covers the most important aspects of texas' sales tax with respects to vehicle purchases. motor vehicle sales tax is due on each retail sale of a motor vehicle in texas. The first texas motor vehicle. Sales Tax Rate For Cars In Texas.

From printablethereynara.z14.web.core.windows.net

State And Local Sales Tax Rates 2020 Sales Tax Rate For Cars In Texas this page covers the most important aspects of texas' sales tax with respects to vehicle purchases. motor vehicle sales tax is due on each retail sale of a motor vehicle in texas. the sales tax for cars in texas is 6.25% of the final sales price. Has a statewide sales tax of. The first texas motor vehicle. Sales Tax Rate For Cars In Texas.

From taxfoundation.org

2021 Sales Tax Rates State & Local Sales Tax by State Tax Foundation Sales Tax Rate For Cars In Texas However, there may be an extra local or county. Has a statewide sales tax of. motor vehicle sales tax is due on each retail sale of a motor vehicle in texas. there is a 6.25% sales tax on the sale of vehicles in texas. The standard state rate is 6.25%, but local. the sales tax for cars. Sales Tax Rate For Cars In Texas.